怎么看都像“中央下一盘很大棋”的英文版,借尸还魂?还是对请君入瓮、瓮中捉鳖的顺手推舟?仅供参考,读者自行判断,用于下半年炒股责任自负。

LEAP/E2020:当中国2009夏末准备从美元圈套逃亡时

海杲译

LEAP/E2020相信,危机下一阶段将从中国梦开始。实际上,中国到底在做什么梦,被捕——如果听华盛顿说法的话——价值1万4千亿美元资产的“美元圈套”?如果我们相信美国领导人还有大量媒体专家的话,中国只能继续做一个囚徒的梦,甚至只能继续增强囚徒困境,不断购买美国政府债券和美元。

实际上,每一个人都知道囚徒的梦是什么,当然是从监狱逃跑了。因此,LEAP/E2020毫不怀疑,北京不断努力寻求解决途径,用尽可能快的速度,从美国国库债券和美元有毒资产山坡疾驰而下,以保留13亿中国囚徒的财富。

在一些美好的逃跑故事中,囚徒并不会花费时间宣布他们准备逃跑。实际上正相反,会装傻迷惑警卫的戒心。根据我们团队的研究,中国在3月24号宣布,想用国际储备货币来替代美元,既“测了下水深”,也是一个警告:这是后美元时代势力评估的直接投票(特别在G20内)(1),是对全球玩家的一种建设性和破坏性的警告(视他们对之前想法的反应而定)。有责任的玩家(北京就是一个)给其它玩家必须发出谨慎的信号,才可能继续进行或帮助“计划工作”,准备(2)大逃亡任务的执行(3)需要一些伙伴的协作,因为若是不被告知,没有人会愿意合作,那也不会有什么好结果。

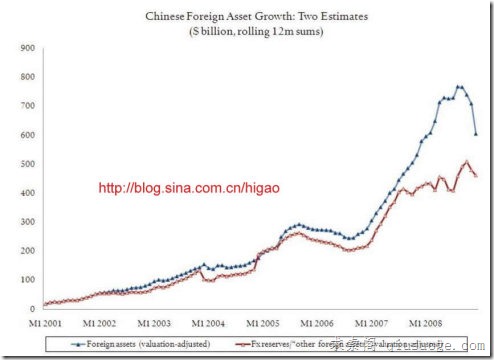

中国外部资产增长的两种估计(十亿美元单位)。来源:中国央行/Brad Setser,01/2009

不管怎样,感谢中国央行的“水深测试”,中国当局确实相信下面四条:

1.其它G20大部分国家很明显偏向于快速(5)转向后美元时代,特别是俄罗斯、印度、南非、阿根廷、巴西……因此北京搞“大跃进”活动(6)并不孤单。正相反,中国将会有拉丁美洲、非洲和亚洲的作伴。最近人民币元和这些国家的交换协议,就已经准备好朝这个方向推进(7)。

2.美国和英国拒绝考虑进一步朝后美元时代方向移动。盖特纳有些失策,当他考虑讨论中国提议时,不过很快被美国政治领导人纠正,但也显示北京处于很有意思的境地。盖特纳是奥巴马团队中华尔街的人,他的失策表明盎格鲁撒克逊金融集团,实际上愿意讨论任何可能维持他们金融特权的方法,即使意味着“美元时代”的终结。依靠华尔街的美元墙并不稳固。金融玩家并不会依恋特定区域(这种特性从我们现在的全球化系统很久之前就有了)。相比之下,华盛顿仍然不想听到任何替代美元作为世界储备货币的想法,而乐于听信安稳型专家的谈话(8)。我们知道次级贷款的结果是什么,金融泡沫、华尔街银行、AIG、TARP、衰退等等。

3.欧洲人(除了英国)还是通常的本性,不能真正做出关于他们前任美国保护者(9)任何决定。他们很成功地抵抗了华盛顿的命令,但不能强迫做出惹恼美国的议程。不管如何,感谢他们的多边性质和多种轮班,很明显,一旦美元时代终结不可逆转,欧洲人会拿出功夫和游说的本事忍耐新国际货币的创建,不会依赖任何特定国家。这也是中国认为SDR(10)可能是美元替代的原因,也表明中国乐于听取其它建议,不仅是人民币元(也是未来欧洲人支持的关键条件)。

4.北京不断诉诸清晰而醒目的宣言,始终平缓地,有时接着甚至就模糊否认,从一些不重要的地方传出,不过很快广泛流传于国际金融媒体。这样的话,便可以在不明显影响美国债券或美元价值的情况下,增加谈论的自由(以及行动,当涉及货币议题时,可以是致命武器或是安慰治疗)。

最后这条,实际上是中国政府根本的需要,避免美国债券和美元价值的崩溃,在成功脱逃“美元圈套”之前。LEAP/E2020相信,在接下来几个月,中国会透出这种要求的真正意义。目标或是必要?如果是个目标,那么华盛顿、伦敦以及国际金融媒体是正确的:北京将会跟着华盛顿的脚步,只是试图增强对美国决定的影响力而已。相比之下,如果是个必要,那我们的团队就是正确的,中国领导人争取最可能的价格,选择最可能的时刻,卖掉美国债券和美元,却又尽可能地避免降低资产价值的骚乱(当然,中国已经在启动逃跑计划之前考虑到各种可能性了)。但是,和第一种选项相比,一旦所有“可能”无效,中国领导人会突然加速美元时代的终结,或者,更可能的是,他们会平静地宣布,由于一些超出控制的原因(11),他们不能继续扮演维持美国失调稳定的角色。

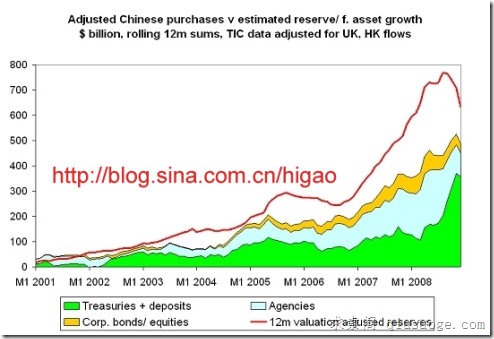

中国购买的美国资产vs.每类资产预计保留(绿色:债券和储蓄/蓝色:政府担保企业债券(房地美、房利美等)/黄色:企业债券/股票/红色:每年预计保留

我们预计在这点上,还要看接下来几个月的趋势变化,来确认我们的分析。从2008年末开始,中国政府就着手每月处理500到1000亿的美元资产。利用对中国经济有益的大量资产的价格纪录低位(矿产、农产品、能源、欧盟或亚洲企业股份——不是美国的,这不是次要细节)。北京按首要需求开始购物,尽力发挥美元资产的用处,也就是说,换成非美元资产,这样才能够继续“大逃亡”。

我们要强调的是,到底这个进程速度有多快。先不说他们方法的不透明(这是保证美元和美国债券免于崩溃的前提,在北京选择时机之前),Brad W. Setser和Arpana Pandey值得注意的研究表明(外交关系理事会2009年出版物发表),中国外汇储备到2008年末时预计总量为2万3千亿美元(也就是说是中国GDP的50%(12)),其中有1万7千亿美元计价资产(9000亿债券,5500亿GSE债券(房地美、房利美等……),接近2000亿企业资产还有400亿短期储蓄)。该研究的作者得出的结论是,北京已经没兴趣再增加大量资产,因为会逐渐增加风险,这是由特别是美国危机所带来的金融和经济决定的(13),现在面临损失的风险,也是因为,在未来不再有钱——由于贸易顺差的崩溃,还有外部投资的缺乏。

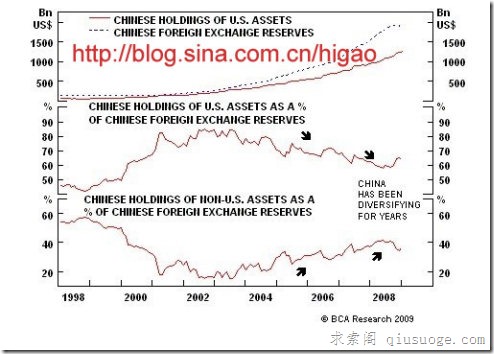

上:中国外汇储备与美国资产比率/下:同上,百分比。来源:BCA研究机构,12/2008

非常符合逻辑,北京正在处理这些巨量过剩外汇储备,它使中国领导人成为美国决策的囚徒,并对他们国家没什么好处,在RGE Monitor于2009年2月21日出版的Rachel Zembia的一篇文章中,非常显著的描述:放贷给东盟国家(14),交换协议,这是400家中国企业以人民币元与亚洲国家贸易的放行(15),放贷给非洲国家和俄罗斯,和波斯湾国家长期特别石油费率的磋商,放贷给巴西和阿布扎比的石油公司,购买欧洲与日本的企业股份(很奇怪,没有美国的),等等。作者强调了这个事实,这些协议要保证中国企业对这些资源的利用。与表面相反,北京分别处理美国债券和美元交换资产的交易,真正攸关的是,这是国家的需要,也更因为价格记录低位,在美国债券和美元还有些价值的时候。

关于美国债券,中国已经停止大规模购买(2009年第一季度减少1460亿,相比去年同一时期,仅增加7亿美元!(16),而且只买短期(3个月)债券(17)!

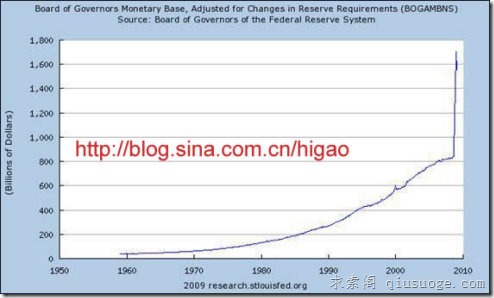

事实是,最终几乎会停止购买美国债券,加速全球化购物,每月超过500亿美元(包括交换协议),它表明,在2008年末和2009年夏末之间,中国将处理6000亿的美元资产,不会购买5千到1万亿的美国债券,这是奥巴马政府说要负担奢侈借入的数字。LEAP/E2020估计,北京很明显要在2009年夏末给美元时代以重击,这也正好是美国财政年度的末尾。中国的处理,单独不买美国债券,表示美国财政所需1万1千亿到1万6千亿的短缺。伯南克将被迫印刷美元,徒劳阻止他的国家停止兑付债务。

美国货币基础。来源:Réserve fédérale US,03/2009

据人们所知,每当伯南克宣布美联储购买自己的美国债券,他们将一天丢失10个百分比价值,相比其它国际货币,也就是1400亿。中国领导人当然会发现,损失了4000到5000亿美元。

LEAP/E2020相信,这个阶段,他们会考虑尽可能用好美元资产。然后,最好也是按下“按钮”——或者并不阻止。中国“大逃亡”的第二阶段开始了,这要看其它的关键玩家了。除了人民币元是国际储备货币,还有欧元、日元、卢布、里亚尔,或是基于这些货币的一揽子的新国际储备货币。美元没有成功的可能,而G20将会减为G18(没有美国和英国,日本不再能够逃出中国影响的范围)。要不然,就会出现全球地缘政治性脱钩,这在GEAB N°32已经描述过了,基于经济区,每个经济区都用他们特定的储备货币进行贸易。

原文地址:

Notes:

(1) The corridors at the London G20 Summit were full of discussions about a post-Dollar era. The feedback we got from our own initiative (the Open Letter to the G20 leaders) already proves it. So the declaration of the Central Bank of China on the same day was certainly at the centre of all the serious conversations (not those covered by the media) during and after the London Summit.

(2) Beijing has recently launched a think-tank dedicated to the global economic crisis intended to help Chinese leaders with their decisions. Regardless of the increasing traffic observed since the end of 2008 on LEAP/E2020’s websites coming from China (and Japan too, including spontaneous translations of our public announcements on a variety of websites and blogs), this initiative clearly suggests that China now wishes to distance itself from US and UK analyses which represented, until then, 90 percent of Chinese experts’ sources. Source: ChinaDaily, 03/21/2009

(3) The movie of the same name, based on a true story, shows nothing else. In real life, the lack of meticulous preparation would doom the escape to partial failure.

(4) The main players are perfectly aware that capital is now flowing out of the US at the precise moment when the country’s huge public borrowing requirements substantially increase the need for foreign capital. In January 2009, the net amount of capital that left the US was USD 150-billion. Source: US Department of Treasury, 03/16/2009

(5) In this case, our researchers are talking months, not years (like the experts, who « concede » that there is a problem of status with the Dollar, would like to believe), because the size of the out-of-control US deficits represent a major threat in the short-term for the entire monetary system.

(6) China’s great political leap, which took place in the 1950s, entailed many disastrous collateral effects (millions of people died of the resulting hunger), but no one can tell whether or not the political leadership of the Chinese communist party is ready to take this kind of risk in the event its own survival and/or the country’s internal stability are at stake. European and American analysts pretend to know what Chinese leaders have in mind, because they have a tendency to think of them in their own image. According to our team, the post-Dollar era (if executed in an organized manner, by means of a new international reserve currency based on a basket of currencies, or chaotically by means of a sudden and non-negotiated end to the Dollar era) marks first of all a post-European era (or post-Western, if we estimate that there is an American specificity as far as core values are concerned), and that such an era has surprises in store for Europe- and West-centered people. Those who doubt it should read these remarks from a Chinese central banker on China’s « superior system advantage ». Source: MarketWatch, 04/26/2009

(7) After South Korea, Malaysia and Indonesia, it was the turn of Argentina to sign a swap agreement with China for a USD 14.5-billion equivalent in their currency, thus allowing each country’s businesses to bypass the US Dollar in trade and strengthening the Yuan’s position as international exchange currency outside Asia. Source: AustralianNews, 04/01/2009

(8) This Los Angeles Times article, dated 04/03/2009, is one of the broadest-minded on this subject! But, it is a fact that China is far closer to Sunset Boulevard than to the Beltway.

(9) We say « former protector » because, as the last NATO summit again proved, Europeans and Americans no longer agree at all on the nature of current threats. The war in Afghanistan is becoming a US war only and the Europeans are mostly preoccupied by the reorganization of their strategic relationship with Moscow. In short, the Alliance (with France a member again, as our team announced when Nicolas Sarkozy was elected) is now nothing more than a senior club in need of common goals other than spending some time together and pretending that everyone gets on as well as they did 60 years ago. Unfortunately, « old age is a shipwreck » as Charles De Gaulle used to say.

(10) The idea is unrealistic. Indeed, SDR were killed by the US around 40 years ago. To have any chance of success, a brand new currency must be created (especially as, called« Special Drawing Rights », it would be very unlikely to enhance its reputation outside the strict circle of monetary experts).

(11) For which they will hold the US responsible: extravagant deficits, incapacity to stimulate economy… the reasons will be many at the end of summer 2009.

(12) On this subject, our team emphasizes that, contrary to the suggestions contained in Chinese leaders’ recent enthusiastic speeches suggest, China’s economic situation will not significantly improve this year. Between collapsing exports, an exploding housing bubble and soaring unemployment, Chinese GDP will remain stable in 2009 (or increase 2 to 3 percent maximum). This situation will strengthen Beijing’s intention to turn its back on all the strategies which led it into this situation for which the scapegoat is obvious. Sources: Financial Times, 04/13/2009; Chinaview, 04/02/2009; New York Times, 04/02/2009; ChinaDaily, 03/19/2009

(13) For instance, the AAA rating of the United States is a complete farce, as this article published in SeekingAlpha on 30/03/2009 explains. The whole country, companies, households, public services, are acquiring junk-bond status… but the federal government is still rated AAA! Rating agencies (all of whom are American) have well deserved the USD 400 billion they were paid by the federal government to help them in assessing the value of USD 1,000 billion worth of toxic assets that it is about to purchase from the banks. Assets which, of course, were rated AAA two years ago by the same agencies. But Beijing, as well as the rest of the world, has now fully understood the fraud. Source: BusinessInsider, 04/07/2009

(14) Source: MarketWatch, 04/12/2009

(15) Source: ChinaDaily, 04/12/2009

(16) Source: ChinaDaily, 04/11/2009

(17) As Brad Setser indicates, in 2008, China absorbed nearly half the foreign purchases of US Treasuries.